A Bundle Of Expectations!

The performance of Indian stock markets has been exceptional, with investors experiencing a wave of optimism. This buoyant sentiment on Dalal Street has soared to unprecedented heights, with the Nifty index reaching a new record high of 24,661.25.

The fear of missing out (FOMO) is evidently influencing traders’ mindsets, driving a trend of bargain hunting and value buying. Investors are eagerly anticipating further market gains as all eyes turn to Finance Minister Nirmala Sitharaman’s Union Budget presentation in the Lok Sabha on July 23rd at 11 A.M.

Nirmala Sitharaman bears the significant responsibility of demonstrating to global investors that Prime Minister Narendra Modi’s economic vision remains potent. Expectations for the Union Budget 2024 are exceptionally high, surpassing those for the Interim Budget. Therefore, this Union Budget must be transformative and align with the reformative promises made by the BJP government.

As we approach the budget announcement, all attention will be focused on Finance Minister Nirmala Sitharaman, a key figure in Modi’s cabinet renowned for her influential role in shaping the country’s economic policies. It is hoped that FM Sitharaman will deliver a balanced budget that prioritizes job creation, capital expenditure, manufacturing, infrastructure, the rural economy, and deficit control, thereby steering the economy back on track and fulfilling the nation’s high expectations.

Long story short: In summary, all eyes will be on the Finance Minister to see if she can support economic growth while controlling deficits. This decade is poised to be India’s. Therefore, it is crucial to introduce a taxpayer-friendly tax regime that paves the way for a USD 5 Tn economy. The economic blueprint should meet the nation’s expectations and propel the Indian economy into the top three global economic powers by 2030.

BEFORE WE START, FIRST THINGS FIRST

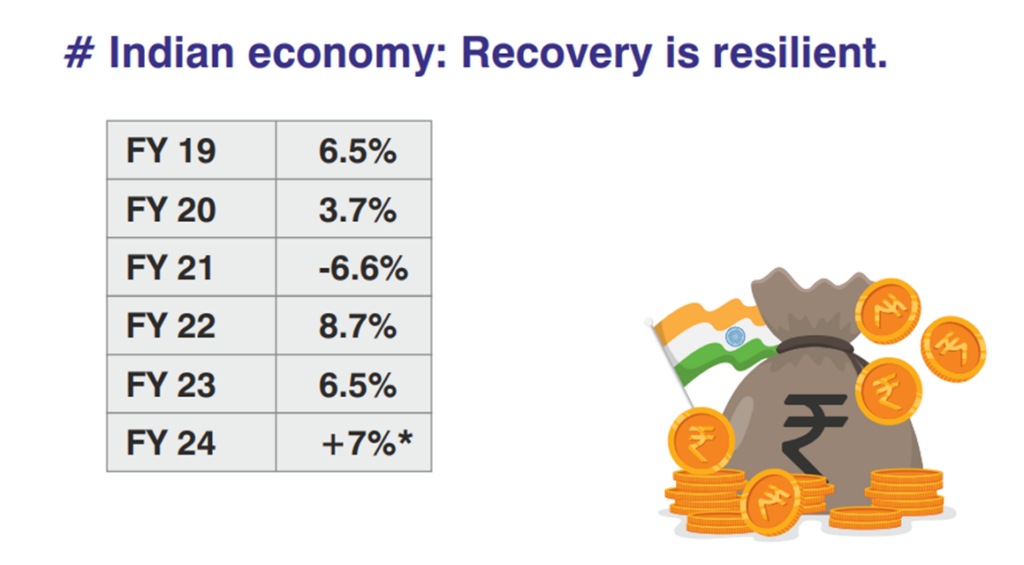

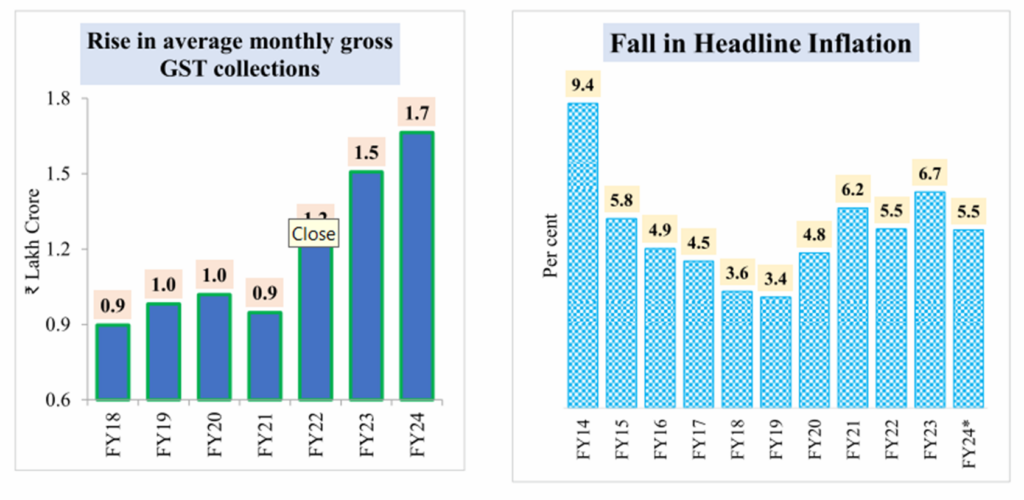

1) The World has recognized the Indian Economy as a ‘bright star’ as the Economic Growth is estimated at 7%, which is the highest among all major economies of the world.

| Indian Economy in a “Sweet Spot” | ||

| 2024 | 2014 | |

| GDP | 6.8% | 7.41% |

| Inflation Rate (CPI) | 4.83% (April) | 6.67% |

| Foreign Exchange Reserve | 641.6 bn USD | 304.2 bn USD |

| Fiscal Deficit | 5% (April) | 4.1% |

| CapEX Trends | 11.1% | 9.01% |

| Services (Growth Rate of GVA) | 9% | 8.16% |

| Agriculture & Allied Activities | 3.06% | 2.6% |

| Industrial Growth | 9.9% | 6.34% |

2) Investors’ confidence grows on backdrop of economic dynamism.

| Dalal Street – Now & Then | ||

| NIFTY Levels | Market-Cap (BSE) | |

| 2024 | 24,500 | ₹ 400 lakh crore |

| 2014 | 8,248 | ₹ 81 lakh crore |

| % Gain | 196% | 394% |

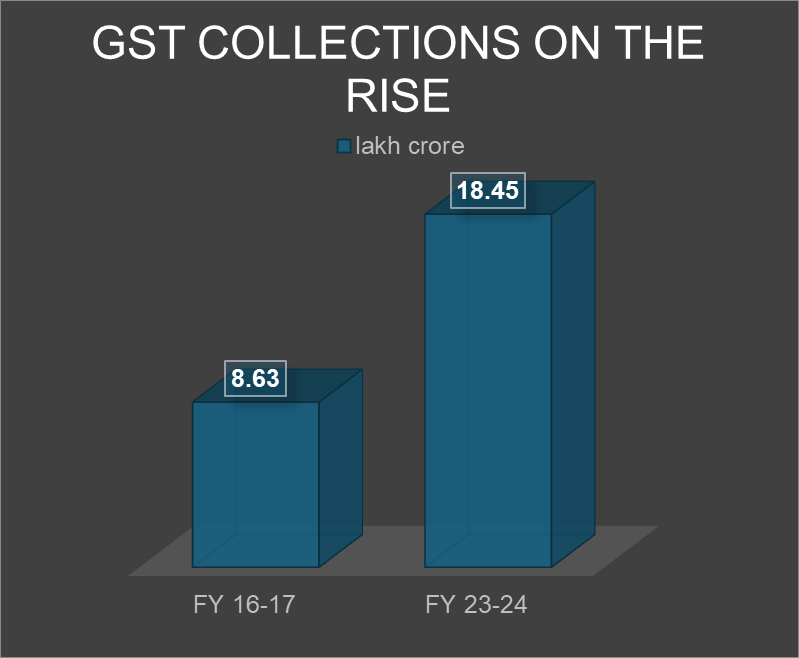

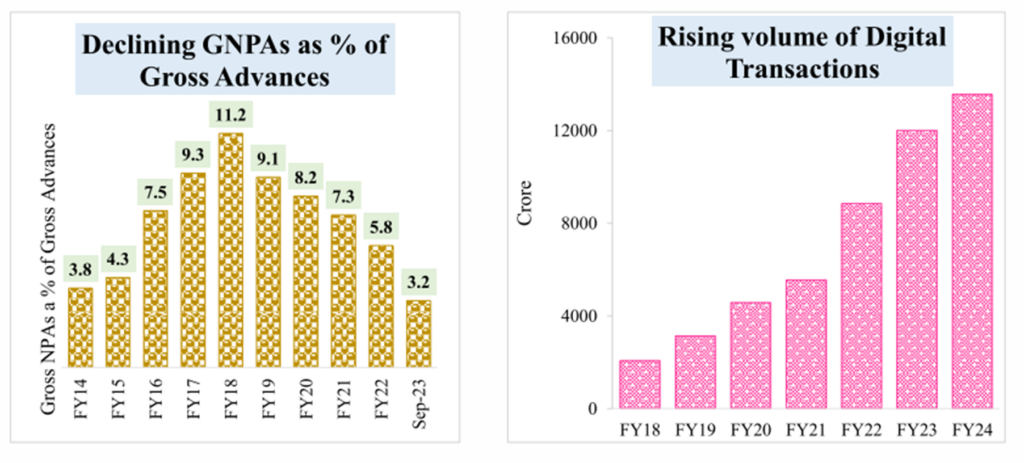

3) GST Collections on the rise:

8.63 lakh Crore in FY16-17

18.45 lakh Crore in FY23-24

4) Boosting India’s rising global profile are accomplishments in unique world class digital public infrastructure namely:

1) Adhaar

2) Co-Win

3) UPI

5) A better quality of life for all citizen a better quality of living a life of dignity as the per capita income has more than doubled to INR 1.97 lakh in around nine years.

6) Affordable health for all (Enhanced Health Expenditure: 2.5% of GDP in FY23).

7) The Indian economy has increased in size in last 9 years From being 10th to 5th largest in the world (The street is now exited as in PM Modi’s third term, the Indian economy is likely to be the 3rd largest economy.

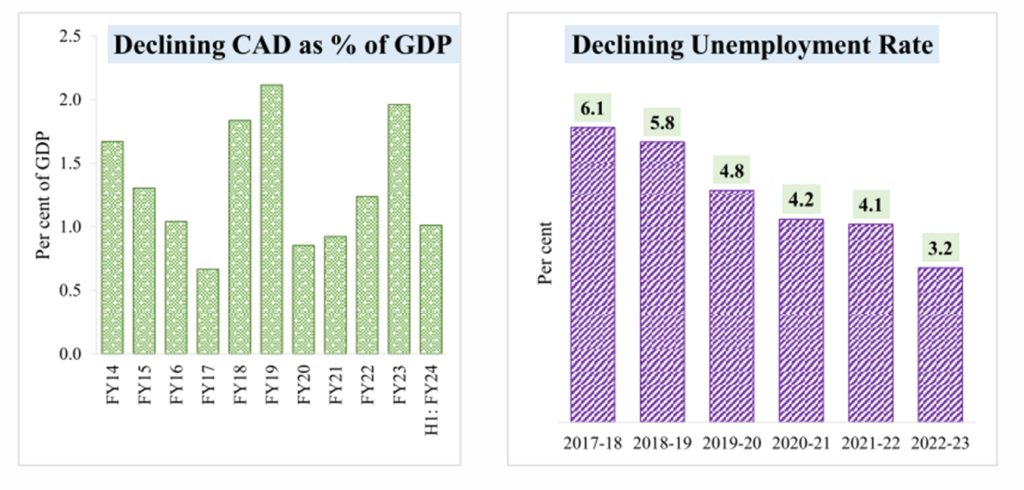

The Spotlight on Indian Economy in 7 Charts.

The Reserve Bank of India (RBI) maintains that the Indian economy is likely to grow at 7% in the current fiscal year 2024-25.

The RBI said, India’s GDP growth is robust on the back of solid investment demand which is supported by healthy balance sheets of banks and corporates, the government’s focus on capital expenditure and prudent monetary, regulatory and fiscal policies.

Indian economy, is well-placed to step up growth trajectory over the next decade in an environment of macroeconomic and financial stability.

“As headline inflation eases towards the target, it will spur consumption demand especially in rural areas.”

The biggest risk to these estimates: Any interest rate hike by the US federal Reserve which can bring down the US economy into recession, global crude price volatility amidst brewing Middle-East geopolitical tension; sluggish growth/constant contraction in merchandise exports; possibility of significantly low net foreign Direct investment (FDI) infloes; deficiency in any south-west monsoon (SWM).

The Key Budget Expectations 2024-25

The Budget expectations are running high.

The good news is that investors are seeing the recent Lok Sabha results as cue to continuation of the Narendra Modi 3.0 government policies.

The street is expecting a continued push for economic reforms that have seen India emerge as the world’s fastest-growing major economy.

We too suspect that confidence of the Modi government is expected to roll out and be boldly become visible in upcoming budget on July 23rd 2024, under the leadership of Hon’ble Finance Minister Nirmala Sitharaman.

Subsidies for domestic production echo through the corridors of power, promising a boost to semiconductor firms and electric vehicle makers.

India’s FY25 budget is likely to prepare ground to position India as a formidable alternative to China’s dominance in global supply chains and shall offer a crucial glimpse into the government’s priorities and spending plans. The spotlight will be on the finance minister’s measures to address fiscal stability, inclusive development, infrastructure investment, green growth, and strategic tax adjustments.

This will be Sitharaman’s seventh consecutive budget. Like the previous three full Union Budgets and one Interim, the full Union Budget 2024-25 will also be delivered in paperless form.

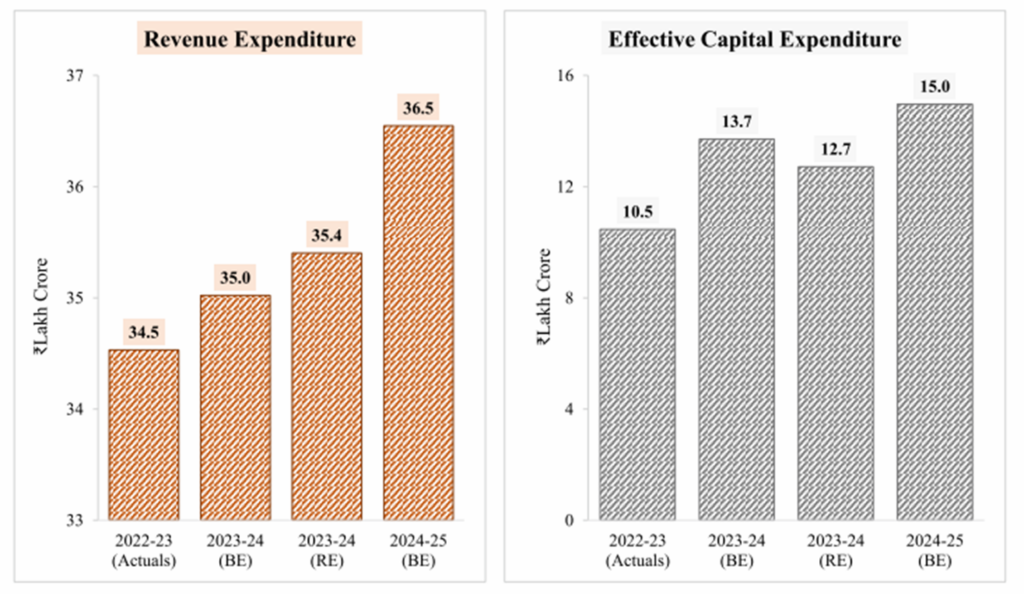

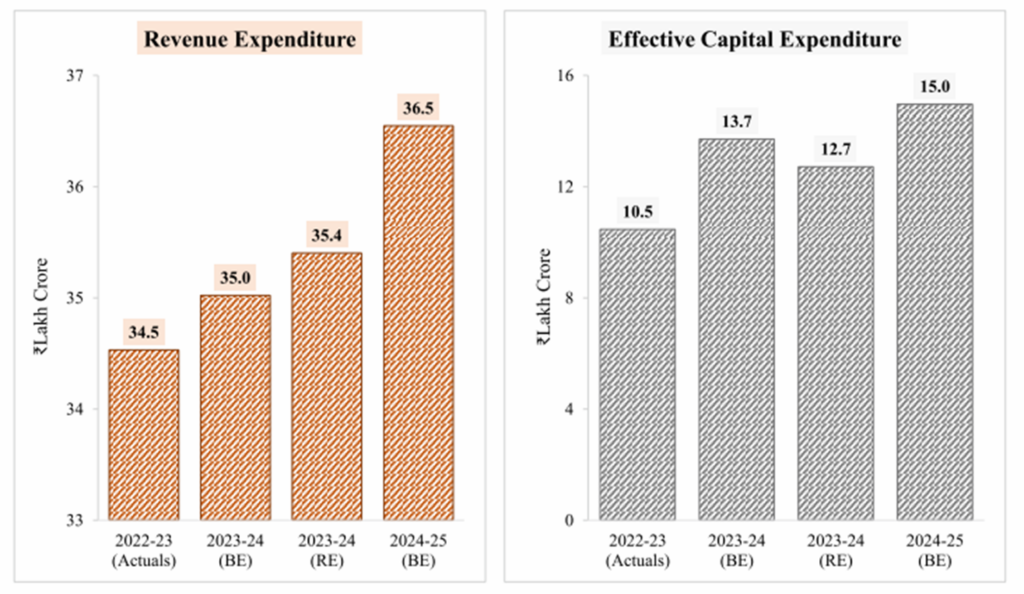

Government needs to strike balance between fiscal consolidation and incremental capex in FY2025 Budget.

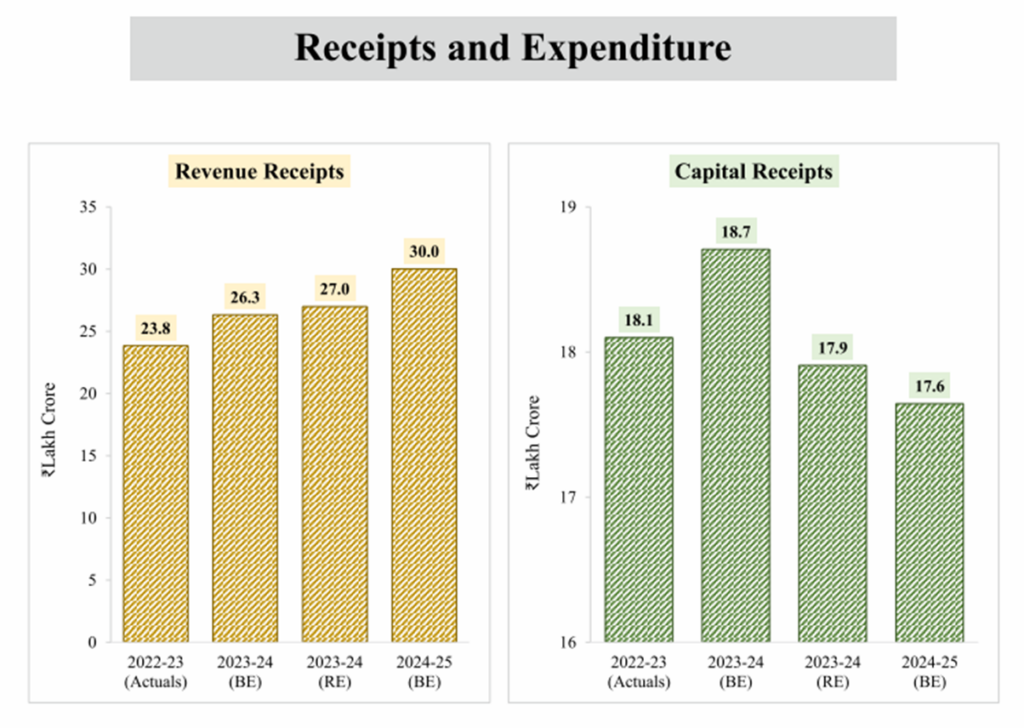

1)The GoI should signal a movement towards the stated fiscal deficit target of 4.5% of GDP in FY26. The budgeted fiscal deficit to GDP ratio of the GoI is 5.8% for FY24. The street will spy with one big eye if the GoI lays out annual reduction targets to achieve the norm of 3% of GDP latest by FY28.

2)The theme of the budget will continue to revolve around increase in healthcare spending, especially after COVID-19. Extra provisioning for vaccine related costs likely. The government is expected to focus on stepping up spending in priority sectors such as healthcare, the social sector, education and support to sectors like hospitality, retail, aviation, infrastructure, agriculture, construction and housing.

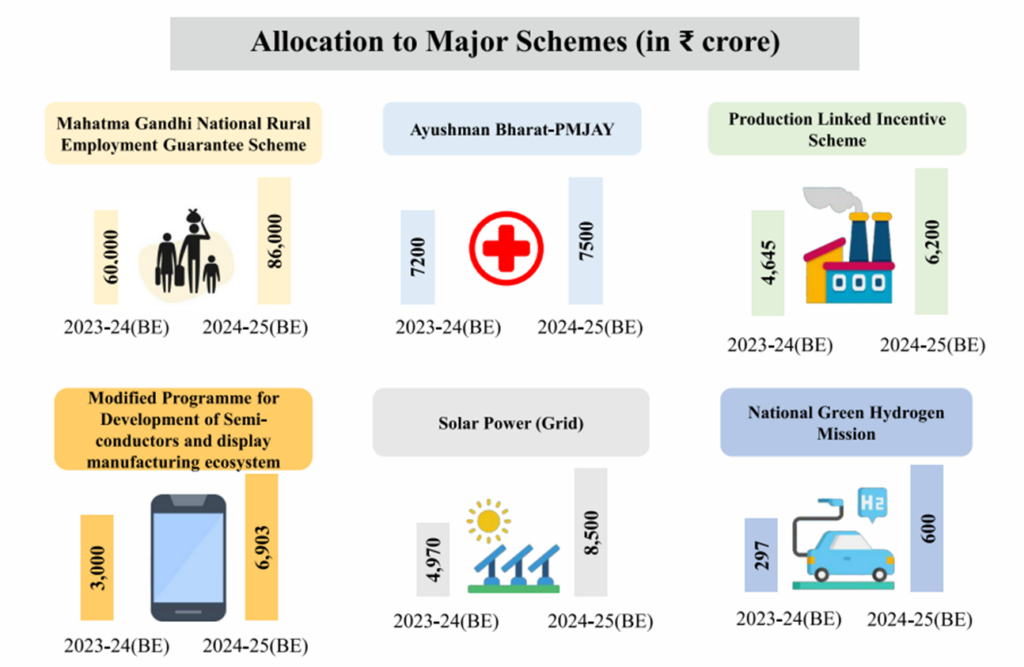

3)The government will also look to come out with aggressive policies to emerge as a viable option for foreign firms exiting China. To bolster the theme the Indian government will look to building and strengthening India’s supply chain capacity, and most importantly, simplify legislations supported by liberal tax compliance regime. Production linked incentive (PLI) scheme details including investment and production thresholds for the extended sectors are awaited. The PLI scheme is currently extended to several sectors including auto omponents, telecom and networking products, advanced chemistry cell batteries, textile, food products, solar modules, white goods, and speciality steel.

4)Ease of doing business is the need of the hour to lure big foreign firms eager to locate in India. The Government should consider curtailing the scope of transactions covered under TDS compliances, relaxations to non-resident taxpayers in return filing compliances where taxes have been appropriately withheld and provide clarifications on certain vexed issues particularly on the new charge of Equalisation levy and TDS/TCS provisions on e-commerce and also abolish applicability of Income Computation and Disclosure Standards. The industry needs efficient and sustained incentive policies to create a viable investment environment. The government should expedite and bring more clarity on PLI, PMP and FTP in the Union Budget.

5)The budget should go a long way in doubling farmers’ income by addressing incentives for the fertilizers, more thrust on irrigation, food processing, logistics, and most importantly on the research & development. The key expectations of farmers are export curbs such as the imposition of minimum export price, a quantitative limit on shipment, export duty, and an outright ban tend to negatively impact farmers’ incomes. The street will also spy with one big eye on the ongoing farmer protests against the introduced new farm laws. Commanding attention would be the government’s commitment towards minimum support prices.

6)The new normal these days are ‘Work-from-home’. The budget should introduce standard deduction for additional expenditure incurred by salaried class to meet communication and infrastructure requirements. Also, the Government should consider increasing the limit of interest deduction paid on home loan as the pandemic has accelerated demand for bigger new homes to accommodate working space. So, incentives to support the real estate sector may include higher tax exemptions on interest and principal payments on housing loans. This will help the real estate sector immensely.

A key area of focus and need of the hour is to generate jobs, especially in the rural economy.

7) The GoI has missed its divestment target for the fifth year in a row. In the last full Budget, the government had set a divestment target of ₹51,000 crore for FY24 and could garner around ₹10,000 crore, which was just 20 percent of its original target. Disinvestment Target likely to be slashed for FY25 amidst rising uncertainty in a tense global environment and also unfavourable market conditions. For FY25, we suspect the government will settle for a lower divestment target of Rs 50,000 crore.

8) Investors and Traders seek removal of STT and LTCG…Honestly speaking, transaction cost in India is too high and LTCG and STT are seen as a sentiment dampener for the market. Way back in 2004, security transaction tax (STT) replaced the long-term capital gains (LTCG) tax. Budget 2018 brought back LTCG, levied again at a rate of 10% on annual gains of over Rs 1 lakh but STT was not removed. The biggest positive trigger for Dalal Street in the upcoming Union Budget 2022 could be abolition of Securities Transaction Tax (STT). Investors will also want LTCG to be removed. This should give boost to the new investors who have started their investment journey in last 12–36 months.

As requested also by ANMI, the government should provide tax exemptions of up to ₹1 lakh in STCG. At present, STCG on equity shares (listed), which have suffered STT, are taxed at 15 percent plus surcharge, without any tax exemptions like in the case of long-term capital gains (LTCG).

Short-term capital gains from equities are taxed at 15% while long-term capital gains over Rs 1 lakh are taxed at 10%. The government levies a 0.1% STT on each equity sale or purchase transactions on exchanges. Short-term capital gains on all other assets are taxed as per an individual’s income tax slab, while long-term capital gains are taxed at 20% with indexation benefit.

AUTOMOBILE SECTOR

The Indian automobile industry has historically been a good indicator of how well the economy is doing as it contributes almost 6.4% of India’s GDP and 35% of manufacturing GDP and is a leading employment provider.

Digging deeper, the sector is currently grappling with a complex tax structure and most importantly, India is going through one of its roughest phases and under tremendous pressure due to the pandemic coupled with the rise in commodity prices, increased input, shipping, and logistics costs for automobile producers. Meanwhile, the global semiconductor shortage forced companies to reduce their production, despite strong demand.

Budget Expectations:

1.Awaiting Budget 2024 with high expectations for the Electric Vehicle (EV) industry. The sector is hoping for some level of rate rationalisation to reduce interpretative issues and litigations.

2.Automotive Component Manufacturers Association (ACMA) is seeking relaxations, including a uniform GST of 18% on all auto parts, from the central government in the upcoming Union Budget as this help remove an inverted duty structure that restricts working capital.

3.The industry expectation is that the Government of India (GOI) introduces more multiple initiatives like scrappage policy, performance-linked incentive (PLI) scheme for electric vehicles (EVs) and advanced technology components, expanding the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME) II and PLI schemes and increasing the scope for start-ups and MSME, the vehicle scrappage policy, and more on the recent announcement of the PLI scheme for semiconductors which are likely to be a big step in the right direction.

Best Plays: Maruti, ASHOK LEYLAND, BAJAJ AUTO.

INFRASTRUCTURE SECTOR

Infrastructure sector is and will continue to be a key driver for the Indian economy as we aim of reaching a US$ 5 trillion economy by 2025, infrastructure development is the need of the hour.

Finance minister Nirmala Sitharaman’s Budget for 2023-24 had underlined sustained focus on the northeast for “inclusive development” as one of the seven priorities, which act as the ‘Saptarishi’ guiding the government “through the Amrit Kaal“.

The big bang economic push with outlay for capital expenditure was seen in the Interim Union Budget 24 which was stepped up sharply by 11.1% from Rs 10 lakh crore in the current year to Rs 11.11 lakh crore or 3.3% of the GDP in 2024-25. The effective capital expenditure (Capex) will be Rs 13.7 lakh crore, 3.4% of GDP.

Indian logistics sector accounts for 5% of India’s GDP and provides jobs for nearly 2.2 crore Indians and the market is estimated to touch US$ 320 billion by 2025 and reach US$ 650.52 billion by 2028, growing at a CAGR of 8.3%.

According to the mentioned World Bank report, India will require to invest $840 billion over the next 15 years into urban infrastructure to effectively meet the needs of its urban population.

With almost all central banks are tightening the monetary policy to combat the inflation – the chorus of recession is growing louder and louder with many of the large economies expected to get into recession.

Budget Expectations:

1.Public investments and enhanced infrastructure investment need to be stepped up as the burden for economic growth in FY25 would fall again on the government. Along with fund allocations, the government should also ensure sustained monitoring.

2.The Ministry of Road Transport and Highways has requested a budgetary allocation of Rs 3.25 lakh crore for FY 2024-25, marking a 25% YoY increase

3.Enhance opportunities for private investment in infrastructure that will assist all stakeholders for more private investment in infrastructure, including railways, roads, urban infrastructure, and power. The industry anticipates heightened government emphasis on safety and timely infrastructure upgrades in the country.

4.There is an urgent need to improve technology and digital adoption in construction industry. Dependence on unskilled labour is one of the vulnerabilities of the infrastructure sector. The sector needs to invest in skilling, modern machinery, automation and digitization. Please note, in the developed markets and most importantly, in China the large infrastructure projects rely more on technology and automation and less on manual labour.

5.The introduction of schemes like the Atal Mission for Rejuvenation and Urban Transformation (AMRUT) 2.0 and Swachh Bharat Mission (SBM) 2.0 in recent years, higher allocations for these sub-sectors are expected this time.

6.Removing obstacles and speeding up process for land acquisition for infrastructure projects.

7.Prioritise rural and urban connectivity, railways, ports, aviation, and highways for their significant impact on growth and employment.

Best Plays: LARSEN, ITD CEMENTATION.

FINANCIAL SECTOR

India hosts a vast network of banks and non-banking financial companies (NBFC). The sector plays a big role in facilitating credit, infrastructure, and investment in the country.

Rising income is driving the demand for financial services across income brackets.

Investment corpus in Indian insurance sector might rise to US$ 1 trillion by 2025.

With >2,100 fintechs operating currently, India is positioned to become one of the largest digital markets with rapid expansion of mobile and internet.

As of November 2023, there were 33 private and public banks licensed in India. Besides these major banks there a nearly 100,000 urban and rural cooperative banks.

In financial year 2023, private sector banks in India recorded assets worth over 1,016.93 billion U.S. dollars while 12 public sector banks (PSBs) had assets worth over $1.7 trillion. This makes the banking and finance sector a vital part of the Indian economy and the backbone of any economy.

It has faced a lot of heat due to the pandemic and now seen rebounding. Bank credit is seen growing 15 per cent per annum in fiscals 2023 and 2024, riding on broad-based economic recovery and stronger, cleaner balance sheets that allow lenders to expand credit.

Budget Expectations:

1.The sector should remain strong for sustainable economic growth.

2.For Banks, focus would be on PSU Bank Privatization and Digitalization Perks.

3.Major expectation includes a higher recapitalization amount for PSU Banks as they could rely on market borrowings. But market participants would look for a roadmap to reduce the government’s stake in public-sector banks. The Budget should include fast-tracking the public sector bank (PSB) privatisation programme. This would help improve the efficiency of small and medium PSU Banks

4.The street expects that the Small Industries Development Bank of India Bank of India (SIDBI) or NABARD (National Bank for Agriculture and Rural Development) should be made as the agency for offering active liquidity support to the NBFCs.

Best Plays: SBI, CANARA BANK, PNB, INDIAN BANK, BANK OF BARODA, UNION BANK OF INDIA, ICICI BANK.

REAL ESTATE AND HOUSING FINANCE COMPANIES

In India, the real estate sector is the second largest employment generator after the agriculture sector.

The Indian real estate sector is expected to reach $1.04 trillion by 2029 and contribute 13% of the country’s GDP by 2025.

The Private Equity Investments in India’s real estate sector, stood at US$ 4.2 billion in 2023.

FDI in the sector (including construction development & activities) stood at US$ 56.03 billion from April 2000-March 2023.

The Indian real estate sector witnessed strong private equity (PE) investments of US$ 1.92 billion

In the Union Budget 2023-24, a commitment of Rs. 79,000 crore (US$ 9.64 billion) for PM Awas Yojana has been announced, which represents a 66% increase compared to the last year.

Budget Expectations:

1.The government could provide a further boost to the affordable housing segment by increasing the tax exemption limit for home loans.

2.Growth momentum needs to be maintained in the face of difficult macroeconomic conditions marked by high inflation and rising interest rates. At the moment, many a global investors are on a wait-and-watch mode as recessionary pressures persist

Best Plays: OBEROI REALITY, DLF, GODREJ PROPERTIES.

STOCK TO WATCH OUT FOR IN DEFENCE

As we analyse top defence stocks listed at Dalal Street — we get the same outperforming stocks coming up on the radar primarily on backdrop of consistent demand, government backing, and long-term contracts.

Well, defence stocks have increased to over their historic all-time-highs and most importantly, present a secure investment choice on backdrop of:

Budget Expectations:

1.Defence Budget: (FM Sitharaman allocated a staggering Rs 6.21 lakh crore for India’s Ministry of Defence during the Interim Budget presentation in February. This marked a substantial portion of 13.04% of the Union Budget). Upward trend continues in Defence Capital Expenditure promoting ‘Aatmanirbharta’ (By 2030, the Indian defence budget is likely to grow to $200 billion).

2.Geopolitical Concerns: War in Ukraine, an attack on Israel from Hamas, the Gaza-based terrorist group, tensions arising from China’s military presence off the coast of Taiwan, border tensions. (and internal conflicts calls for renewed focus on the security and defence industry).

3.‘Make in India’ initiative and Export Potential: (Despite boasting the world’s fifth-largest Defence budget), India sources a staggering 60% of its weapon systems from international markets. It’s time for India to not only address its fiscal woes but also assert its security, sovereignty, and economic interests. (The good news is that the Indian government is trying to strengthen the nation’s defence prowess by reducing dependence on imports. Large and sustainable opportunities for domestic players also exists particularly in engineering services and component sourcing, on backdrop of goal of reaching ₹50,000 crore in exports by 2029-2030). India shall be leading global defence manufacturing hub sooner than later.

Best Plays: HAL, BDL, ZENTAC, DATA PATTERNS

UNION BUDGET OUTLOOK FOR RAILWAYS

The Union Budget 2024 is expected to be an extension of the Interim Budget itself, and we suspect there is further steam left in the Railway Stocks space on the back of robust order books and improving earnings quality.

The future outlook of the railway sector looks on ‘RIGHT TRACK’

We say so because, the Indian railway industry is still the backbone of India’s transportation system and is also the fourth largest railroad network in the world.

India is projected to account for 40% of the total global share of rail activity by 2050.

The railway sector has seen some rapid developments, investments, and support from the Government.

In a big step in modernising rail mobility and connectivity, the FM also announced capital outlay for Railways at Rs 2.55 lakh crore, about nine times the outlay made in FY 2013-14.

The Capex shall help create employment opportunities. We suspect, the Indian economy is likely to show strong resilience and should come out with strong growth.

Finance Minister Nirmala Sitharaman in her speech also added that three major economic railway corridor programmes will be implemented. These projects have been identified under the PM Gati Shakti for enabling multi-modal connectivity.

These projects are:

1) Energy, mineral and cement corridors

2) Port connectivity corridors

3) High traffic density corridors.

| Sector: Railway Stocks Performance from last Three-budgets | ||||

| Stock Name | CMP(Rs) July 15th 2024 | Market Cap (Rs Cr) | YTD Return % | 3-Years Resturn % |

| IRFC | 219 | 285874 | 120% | 776% |

| RVNL | 627 | 130825 | 245% | 2026% |

| IRCTC | 1043 | 83448 | 17% | 351% |

| BEML | 5007 | 30847 | 77% | 566% |

| JUPITER WAGONS | 705 | 29065 | 121% | 2965% |

| TITAGARH RAIL | 1710 | 22289 | 58.5% | 2954% |

| RAMKRISHNA FORGING | 910% | 16458 | 25.5% | 767% |

| TEXMACO RAIL | 286 | 11407 | 67% | 921% |

Best Plays: JUPITER WAGAIN, IRCTC, RVNL, TITAGARH RAIL

| Our best players for Union Budget 2024 | |||||

| Company | Sector | CMP | Tagret | Potential Upside | Investment Horizon |

| BALRAMPUR CHINNI | Sugar | 451 | 551 | 22% | 9-12 Months |

| BANK OF BARODA | PSU BANK | 258 | 315 | 22% | 9-12 Months |

| INDIGO | Airline | 4431 | 5000 | 37% | 9-12 Months |

| LARSEN | Civil Construction | 3637 | 4500 | 24% | 12-15 Months |

| NTPC | Power Generation | 382 | 451 | 18% | 12-15 Months |

| RELIANCE(RIL) | Refineries & Marketing | 3157 | 3900 | 24% | 9-12 Months |

Nifty’s Monthly Chart

| Nifty | CMP 2461 | 3 Technically speaking, a massive breakout seen on the long-term charts. The recent sequence of higher high/low is intact on all-time frames. If Nifty moves above its psychological 25,000 mark, then there is a bright possibility that the benchmark could reach the magnificent levels of 26,000 by next Union Budget. Please note, on the downside good support exists only at 21500-22000 zone and then strong support seen at psychological 20,000 mark. The technical continues to increasingly bullish hence, regrouping at lower corrective declines should be the preferred strategy. |

Bank Nifty Daily Chart

| BankNifty | CMP 52397 | We suspect, Bank Nifty is likely to be a big market performer. Technically speaking, the recent sequence of higher high/low is intact on all-time frames and a massive breakout already being witnessed on the long term charts. If Bank Nifty moves above its all-time-high at 53357, then there is a bright possibility that the benchmark could reach the magnificent levels of 55000 and possibly 57000 by next Union Budget. Please note, on the downside good support exists only at 45000-46500 zone and then strong support seen at psychological 43,000 mark. The technical continues to bullish hence, initiating long positions on strength should be the preferred strategy. |

Long story short: There is a bright chance that FM Sitharaman’s Union Budget 2024-25 can be one in a century budget which takes Nifty straight above the 25,500 mark.

Fingers crossed !!