The Tata Group, one of India’s largest and most respected conglomerates, has grown from a modest trading firm in 1868 into a global powerhouse spanning multiple industries. Over the decades, Tata has not only shaped the Indian industrial landscape but has also provided tremendous opportunities for investors. With a legacy rooted in trust, innovation, and growth, the Tata Group continues to be a beacon for long-term investment opportunities.

A Legacy Built on Trust

Founded by Jamsetji Tata, the Tata Group’s journey began with a vision to set the foundation for India’s industrial progress. From its first textile mills in the late 19th century to its present-day portfolio of companies across various sectors, Tata has always prioritised ethical business practices, a commitment to quality, and a strong focus on community development. This ethical foundation has earned Tata immense trust, making it a household name in India and beyond.

Diversification: The Key to Growth

Tata’s strength lies in its diversified business portfolio, which spans industries such as steel, automobiles, IT services, consumer products, telecommunications, and even aerospace. This diversification has not only shielded the group from market volatility but has also provided investors with a broad spectrum of opportunities to capitalise on the company’s steady growth across various sectors.

- Tata Steel

One of the earliest ventures of the Tata Group, Tata Steel, has played a critical role in India’s industrialization. Today, it is one of the largest steel producers globally, and with rising demand for infrastructure, the company continues to show strong potential for growth. Tata Steel has been a consistent performer for investors, backed by its strategic acquisitions and global expansion.

- Tata Consultancy Services (TCS)

The tech arm of Tata, TCS, is arguably one of its biggest success stories. As one of the world’s leading IT services companies, TCS has consistently delivered strong financial results and boasts a market capitalization that puts it among the world’s largest IT companies. For investors, TCS has been a steady compounder of wealth, offering robust returns through consistent dividends and capital appreciation.

- Tata Motors

Tata Motors is another flagship entity within the Tata Group, revolutionising India’s automobile industry. Its acquisition of Jaguar Land Rover (JLR) catapulted it to global prominence. With the growing demand for electric vehicles (EVs) and Tata’s push into the EV segment, Tata Motors presents a forward-looking investment opportunity in the evolving automobile sector.

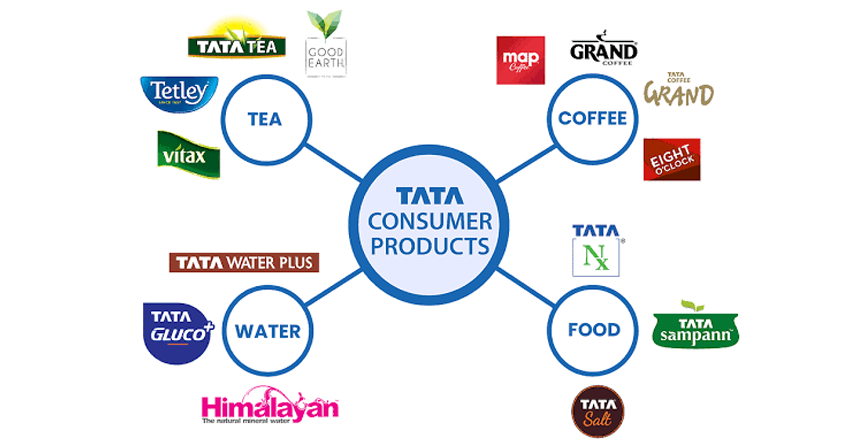

- Tata Consumer Products

With a growing focus on consumer products, Tata Consumer Products is another rising star in the Tata Group. The company owns iconic brands like Tata Tea and Himalayan Water and is rapidly expanding into health and wellness products. As consumer spending in India rises, the company is well-positioned to capture significant market share, providing long-term returns for investors.

- Tata Power

As the world shifts towards cleaner and greener energy, Tata Power has made significant strides in the renewable energy sector. With increasing investments in solar and wind energy, Tata Power offers investors exposure to the growing renewable energy industry, an area of immense potential.

Strategic Acquisitions and Global Expansion

Tata’s strategy of global expansion through key acquisitions has been a cornerstone of its growth. From acquiring steelmakers like Corus in Europe to luxury automotive brands like Jaguar Land Rover, Tata has demonstrated its ability to integrate and expand its businesses on a global scale. This international footprint has not only strengthened Tata’s market presence but also provided investors with global exposure, particularly in developed markets.

Focus on Innovation and Sustainability

One of the driving forces behind Tata’s continued success is its focus on innovation and sustainability. Whether it’s through Tata Motors’ electric vehicle initiatives or Tata Steel’s commitment to reducing carbon emissions, the group is positioning itself to thrive in the industries of the future. This commitment to innovation opens new doors for investors looking to be part of long-term, sustainable growth stories.

Consistent Dividend Payouts and Wealth Creation

For investors, one of the most appealing aspects of the Tata Group has been its commitment to returning wealth to shareholders. Tata Group companies, particularly TCS and Tata Steel, have a long history of paying regular dividends, which, when coupled with capital appreciation, create significant wealth over time. TCS, in particular, is known for its generous dividend policy, providing shareholders with a steady income stream.

Resilience in Adversity

Tata’s ability to weather economic downturns and market challenges is a testament to its solid fundamentals and diversified portfolio. The group has consistently demonstrated resilience in the face of adversity, whether it be the global financial crisis, commodity price fluctuations, or the recent COVID-19 pandemic. This stability is a key reason why Tata continues to be a reliable investment choice for both conservative and aggressive investors.

A Group Poised for the Future

The Tata Group’s evolution over the years is nothing short of remarkable. From its humble beginnings to its current status as a global conglomerate, Tata has continually adapted to changing market dynamics, ensuring consistent growth and wealth creation for its investors. With its commitment to innovation, sustainability, and diversification, Tata is not just a stalwart of India’s industrial legacy but also a beacon of future investment opportunities.

For investors seeking stability, growth, and long-term returns, Tata’s diverse range of companies offers numerous avenues to build wealth. As Tata continues to expand and innovate, it remains a top choice for anyone looking to invest in a legacy of excellence.