The wedding industry in India is not just a celebration of love; it’s a vibrant tapestry woven with tradition, culture, and economic vitality. From elaborate ceremonies to opulent festivities, weddings in India are steeped in rich heritage and offer a kaleidoscope of experiences that captivate hearts worldwide.

The magnitude of Indian weddings today is staggering, with costs reaching levels comparable to the GDP of small nations. Millions and even billions of rupees are invested in these extravagant celebrations of love.

In the 2023-24 wedding season alone, the wedding industry nearly reached a staggering $75 billion, exhibiting a consistent annual growth rate of 7-8%.

A Booming Market:

With approximately 10 million weddings annually, India’s wedding industry is a powerhouse, generating significant economic activity and fostering innovation across various sectors. From hospitality and fashion to travel and finance, weddings serve as catalysts for growth and opportunity.

Destination Weddings: A Global Affair:

Overseas weddings have been a growing trend among Indian couples, with destinations like Dubai, Thailand, and Bali capturing the imagination. However, the tide is turning with initiatives like “Wed in India,” spearheaded by Prime Minister Narendra Modi. This visionary campaign aims to reclaim the ₹1 lakh crore spent on destination weddings by promoting India as a premier wedding destination.

The Hospitality Boom:

The hospitality sector in India experiences a surge in demand during wedding seasons, with hotels and resorts hosting grand celebrations. Major players like Marriott and Hilton capitalize on this demand, hosting thousands of weddings annually and contributing significantly to their revenue streams. This sector relies significantly on weddings, accounting for approximately 12% to 60% of its total annual revenue. In 2022, Marriott hosted approximately 5,000 weddings in India, while Hilton’s 23 wedding-focused properties contributed up to 60% of its annual revenue.

Innovations in Finance:

Financial institutions are also tapping into the wedding market, offering specialized loans and credit schemes tailored for weddings in India. Initiatives like Radisson’s “Marry Now Pay Later” scheme in collaboration with fintech firm “SanKash”, targeting a 0.1% market share. The scheme offers borrowers a flexible credit line of up to ₹25 lakh, with a year-long repayment period including a six-month interest-free EMI option. In line with the industry trend, many banks and NBFCs like Axis Bank, ICICI Bank, IDFC First Bank, HDFC Bank, CASHe, and IndiaLends are offering personal loans specifically for weddings, aiming to capture market share. However, despite tempting offers, only 26% of individuals prefer financing their ceremonies, as per a survey.

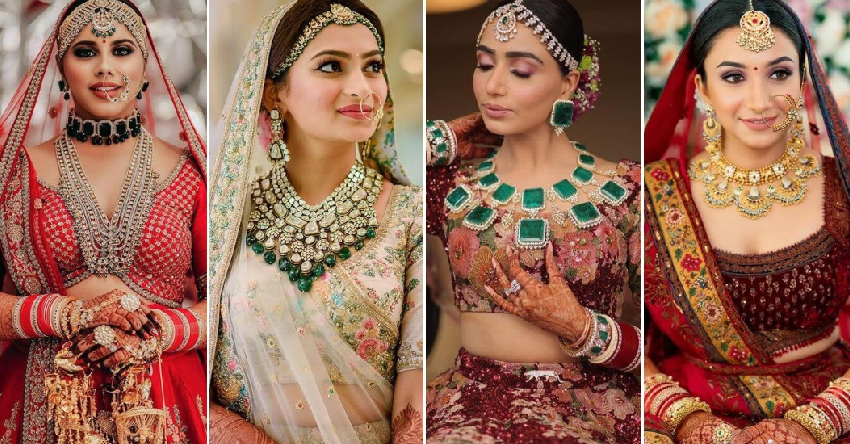

Fashion, Jewellery, and Beyond:

The wedding industry fuels innovation and creativity in fashion and jewellery, with designers and jewellers crafting bespoke ensembles and ornamental pieces that blend tradition with modernity. Themes, decorations, and sustainability are also gaining prominence, offering couples many options to personalize their celebrations. As per the World Gold Council’s recent report, weddings and festivals continue to be key drivers of demand for gold jewellery in India. Bridal jewellery alone captures half of the market share in the country, the world’s second-largest consumer of gold jewellery.

A 20-30% increase in sales is predicated this year due to lower gold prices. He emphasizes the significance of the wedding season for the jewellery industry, noting a consistent growth in demand. It is because of the authentic appeal of gold, particularly with current price trends, and expects a resurgence of traditional designs with modern elements.

The Cultural Tapestry:

Weddings in India are not just events; they are cultural extravaganzas that celebrate diversity and unity. From vibrant rituals and ceremonies to sumptuous feasts and joyous festivities, Indian weddings reflect the country’s rich cultural heritage and values.

As we peel the layers of India’s wedding industry, it becomes apparent that weddings are not just about tying the knot; they are about creating unforgettable memories that transcend time and space. With its blend of tradition, innovation, and hospitality, India continues to enchant couples worldwide, making it the ultimate destination for love, celebration, and new beginnings.