Highlights of Union Budget 2025-26

Honestly speaking, Finance Minister Nirmala Sitharaman has come out with flying colors on her record eighth Budget, focusing on four engines: Agriculture, MSME, Investment, and Exports, to drive the goal of Viksit Bharat, and most importantly, the economic blueprint meets the expectations of the country and should take Indian economy to the top three economic powers in the world over by 2030.

The highlights of the Union Budget 2025-26 presented in the Parliament by Union Minister for Finance and Corporate Affairs Smt Nirmala Sitharaman are as follows:

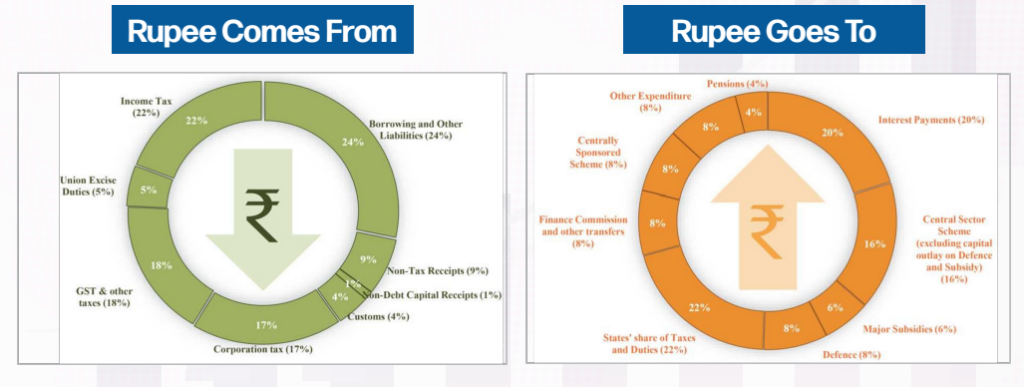

Budget Estimates 2025-26

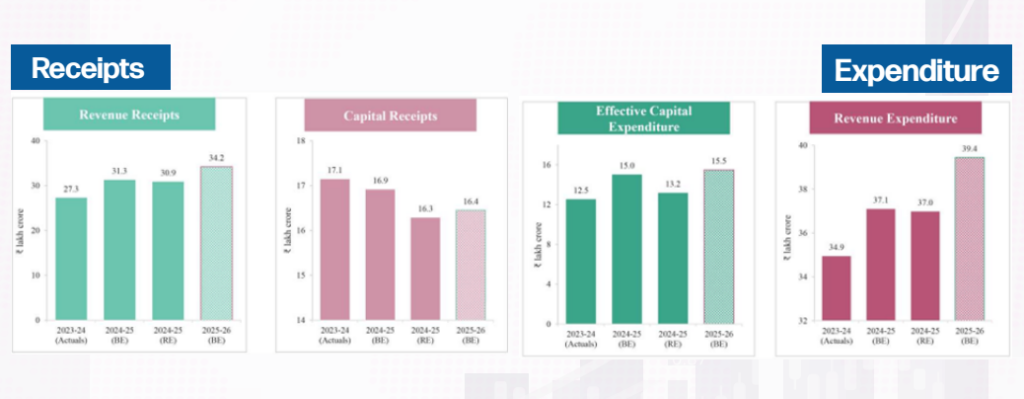

- The total receipts other than borrowings and the total expenditure are estimated at 34.96 lakh crore and 50.65 lakh crore respectively.

- The net tax receipts are estimated at `28.37 lakh crore.

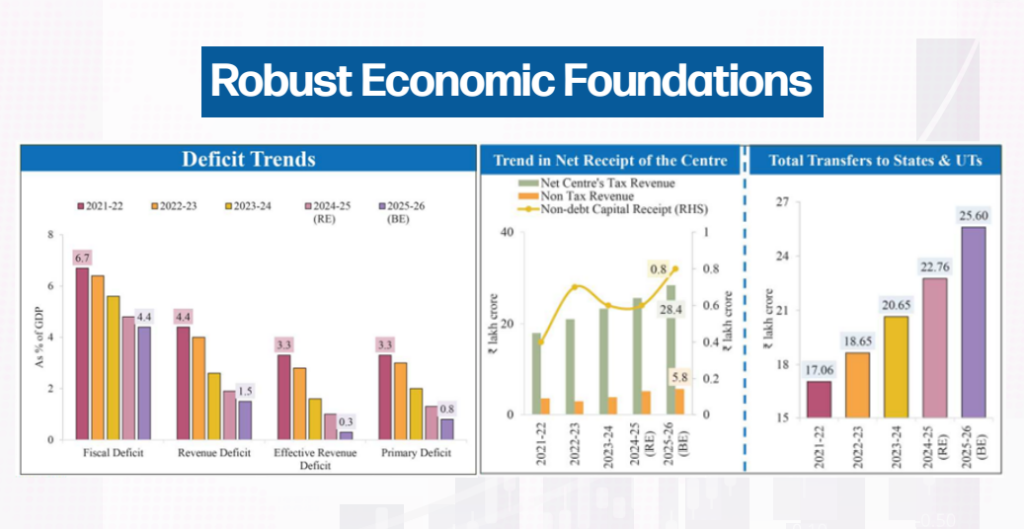

- The fiscal deficit is estimated to be 4.4 per cent of GDP.

- The gross market borrowings are estimated at `14.82 lakh crore.

- Capex Expenditure of `11.21 lakh crore (3.1% of GDP) earmarked in FY2025-26.

Agriculture as the first engine of development

Prime Minister Dhan-Dhaanya Krishi Yojana – Developing Agri Districts Programme The programme to be launched in

partnership with the states, covering 100 districts with low productivity, moderate crop intensity and below-average credit parameters, to benefit 1.7 crore farmers.

Building Rural Prosperity and Resilience A comprehensive multi-sectoral programme to be launched in partnership with states to address under-employment in agriculture through skilling, investment, technology, and invigorating the rural economy. Phase-1 to cover 100 developing agri-districts.

Aatmanirbharta in Pulses

Government to launch a 6-year “Mission for Aatmanirbharta in Pulses” with focus on Tur, Urad and Masoor. NAFED and NCCF to procure these pulses from farmers during the next 4 years.

Fisheries

Government to bring a framework for sustainable harnessing of fisheries from Indian Exclusive Economic Zone and High Seas, with a special focus on the Andaman & Nicobar and Lakshadweep Islands.

Mission for Cotton Productivity

A 5-year mission announced to facilitate significant improvements in productivity and sustainability of cotton farming, and promote extra- long staple cotton varieties.

MSMEs as the second engine of development

Revision in classification criteria for MSMEs

The investment and turnover limits for classification of all MSMEs to be enhanced to 2.5 and 2 times respectively.

Credit Cards for Micro Enterprises

Customized Credit Cards with 5 lakh limit for micro enterprises registered on Udyam portal, 10 lakh cards to be issued in the first year.

Fund of Funds for Startups

A new Fund of Funds, with expanded scope and a fresh contribution of 10,000 crore to be set up.

Scheme for First-time Entrepreneurs

A new scheme for 5 lakh women, Scheduled Castes and Scheduled Tribes first-time entrepreneurs to provide term-loans up to 2 crore in the next 5 years announced.

Focus Product Scheme for Footwear & Leather Sectors

To enhance the productivity, quality and competitiveness of India’s footwear and leather sector, a focus product scheme announced to facilitate employment for 22 lakh persons, generate turnover of 4 lakhcrore and exports of over 1.1 lakh crore.

Measures for the Toy Sector

A scheme to create high-quality, unique, innovative, and sustainable toys, making India a global hub fortoys announced.

Support for Food Processing

A National Institute of Food Technology, Entrepreneurship and Management to be set up in Bihar.

Manufacturing Mission – Furthering “Make in India”

A National Manufacturing Mission covering small, medium and large industries for furthering “Make in India” announced.

Investment as the third engine of development – Investing in People

Saksham Anganwadi and Poshan 2.0

The cost norms for the nutritional support to be enhanced appropriately.

Atal Tinkering Labs

50,000 Atal Tinkering Labs to be set up in Government schools in next 5 years.

Broadband Connectivity to Government Secondary Schools and PHCs

Broadband connectivity to be provided to all Government secondary schools and primary health centres in rural areas under the Bharat net project.

Bharatiya Bhasha Pustak Scheme

Bharatiya Bhasha Pustak Scheme announced to provide digital-form Indian language books for school and higher education.

National Centres of Excellence for Skilling

5 National Centres of Excellence for skilling to be set up with global expertise and partnerships to equip our youth with the skills required for “Make for India, Make for the World” manufacturing.

Expansion of Capacity in IITs

Additional infrastructure to be created in the 5 IITs started after 2014 to facilitate education for 6,500 more students.

Centre of Excellence in AI for Education

A Centre of Excellence in Artificial Intelligence for education to be set up with a total outlay of 500 crore.

Strengthening urban livelihoods

A scheme for socio-economic upliftment of urban workers to help them improve their incomes and have sustainable livelihoods announced.

PM SVANidhi

Scheme to be revamped with enhanced loans from banks, UPI linked credit cards with 30,000 limit, and capacity building support.

Social Security Scheme for Welfare of Online Platform Workers

Government to arrange for identity cards, registration on e-Shram portal and healthcare under PM Jan Arogya Yojna, for gig-workers.

Investing in the Economy

Public Private Partnership in Infrastructure

Infrastructure-related ministries to come up with a 3-year pipeline of projects in PPP mode, States also encouraged.

Support to States for Infrastructure

An outlay of `1.5 lakh crore proposed for the 50-year interest free loans to states for capital expenditure and incentives for reforms.

Asset Monetization Plan 2025-30

Second Plan for 2025-30 to plough back capital of 10 lakh crore in new projects announced.

Jal Jeevan Mission

Mission to be extended until 2028 with an enhanced total outlay.

Urban Challenge Fund

An Urban Challenge Fund of 1 lakh crore announced to implement the proposals for ‘Cities as Growth Hubs’, ‘Creative Redevelopment of Cities’ and ‘Water and Sanitation’, allocation of 10,000 crore proposed for 2025-26.

Nuclear Energy Mission for Viksit Bharat

Amendments to the Atomic Energy Act and the Civil Liability for Nuclear Damage Act to be taken up.

Nuclear Energy Mission for research & development of Small Modular Reactors (SMR) with an outlay of `20,000 crore to be set up, 5 indigenously developed SMRs to be operational by 2033.

Shipbuilding

The Shipbuilding Financial Assistance Policy to be revamped. Large ships above a specified size to be included in the infrastructure harmonized master list (HML).

Maritime Development Fund

A Maritime Development Fund with a corpus of 25,000 crore to be set up, with up to 49 per cent contribution by the Government, and the balance from ports and private sector.

UDAN – Regional Connectivity Scheme

A modified UDAN scheme announced to enhance regional connectivity to 120 new destinations and carry 4 crore passengers in the next 10 years.

Also to support helipads and smaller airports in hilly, aspirational, and North East region districts.

Greenfield Airport in Bihar

Greenfield airports announced in Bihar, in addition to the expansion of the capacity of Patna airport and a brownfield airport at Bihar.

Mining Sector Reforms

A policy for recovery of critical minerals from tailings to be brought out.

SWAMIH Fund 2

A fund of `15,000 crore aimed at expeditious completion of another 1 lakh dwelling units, with contribution from the Government, banks and private investors announced.

Tourism for employment-led growth

Top 50 tourist destination sites in the country to be developed in partnership with states through a challenge mode.

Investing in Innovation

Research, Development and Innovation

20,000 crore to be allocated to implement private sector driven Research, Development and Innovation initiative announced in the July Budget.

Deep Tech Fund of Funds

Deep Tech Fund of Funds to be explored to catalyze the next generation startups.

PM Research Fellowship III.

10,000 fellowships for technological research in IITs and IISc with enhanced financial support.

Gene Bank for Crops Germplasm

2 nd Gene Bank with 10 lakh germplasm lines to be set up for future food and nutritional security.

National Geospatial Mission

A National Geospatial Mission announced to develop foundational geospatial infrastructure and data.

Gyan Bharatam Mission

A Gyan Bharat am Mission for survey, documentation and conservation of our manuscript heritage with academic institutions, museums, libraries and private collectors to be undertaken to cover more than 1crore manuscripts announced.

EXPORTS AS THE 4TH ENGINE OF DEVELOPMENT

Export Promotion Mission

An Export Promotion Mission, with sectoral and ministerial targets, driven jointly by the Ministries of Commerce, MSME, and Finance to be set up.

BharatTradeNet

‘BharatTradeNet’ (BTN) for international trade to be set-up as a united platform for trade documentation and financing solutions.

National Framework for GCC

A national framework to be formulated as guidance to states for promoting Global Capability Centres inemerging tier 2 cities.

REFORMS AS FUEL: FINANCIAL SECTOR REFORMS AND DEVELOPMENT

FDI in Insurance Sector

The FDI limit for the insurance sector to be raised from 74 to 100 per cent, for those companies which invest the entire premium in India.

Credit Enhancement Facility by NaBFID

NaBFID to set up a ‘Partial Credit Enhancement Facility’ for corporate bonds for infrastructure.

Grameen Credit Score

Public Sector Banks to develop ‘Grameen Credit Score’ framework to serve the credit needs of SHG members and people in rural areas.

Pension Sector

A forum for regulatory coordination and development of pension products to be set up.

PART B -DIRECT TAX

No personal income tax payable upto income of Rs 12 lakh (i.e. average income of Rs 1 lakh per month other than special rate income such as capital gains) under the new regime. This limit will be Rs 12.75 lakh for salaried tax payers, due to standard deduction of Rs 75,000. The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment. The new Income-Tax Bill to be clear and direct in text so as to make it simple to understand for taxpayers and tax administration, leading to tax certainty and reduced litigation. Revenue of about `1 lakh crore in direct taxes will be forgone.

Revised Tax Rate Structure

In the new tax regime, the revised tax rate structure will stand as follows:

| ₹0-4 lakh | nil |

| ₹4-8 lakh | 5 % |

| ₹8-12 lakh | 10 % |

| ₹12-16 lakh | 15 % |

| ₹16-20 lakh | 20 % |

Indian economy: Recovery is resilient

Key Figures

Revised fiscal deficit for FY25: 4.8%

Fiscal deficit target for FY26: 4.4%

For 2024-25, the revised estimate for total receipts (excluding borrowings) stands at 31.47 lakh crore, with net tax receipts at 25.57 lakh crore.

The revised estimate for total expenditure is 47.16 lakh crore, including a capital expenditure of 10.1 lakh crore.

Net-net, amidst all enthusiasm, Dalal Street wavered to the policy announcements despite the fact that there was no change in the long- term capital gains tax (LTCG) and the short-term capital gains tax (STCG) structures.

Anyway. We firmly believe FM Sitharaman’s Union Budget ushers a ‘new leg to the bull market’.

The budget has given lots of impetus for pushing consumption as over 85% of personal income tax payers will not need to pay any income tax under the new income tax regime announced by finance minister Nirmala Sitharaman in the Union Budget 2025. This is a move aimed in a big way at a majority of the taxpayers in the country whose annual income is below the Rs 12.75 lakh limit featured in the budget. So obviously, India domestic shinning story will be into play. Hence focus should be consumption boom, railways, hotels, travel services and electronics.

Bottom-line: The Union Budget could be a game changer and represents the reforms of the BJP government as all bullish eyes now aim for India’s ambition to reach the $5 trillion economy goal. Now, that brings us to the big question: What can finally kill this bull market at Dalal Street? Well, going forward, caution is the buzzword at Dalal Street.

Blame it on land mines that are placed here and there — and primarily planted by the 47th president of the United States,

President Donald Trump — which is clearly derailing any optimism at Dalal Street. Strictly speaking, Trump’s policies are likely to determine how the US economy will shape up and Wall Street’s trading theme shall hinge on the same.

Amidst this backdrop, Nifty and its stocks remain unsure on how serious Trump’s Tariff Threats are. The battle going forward will also be between deteriorating technical conditions, vanishing liquidity from FIIs camp, weaker Indian Rupee, and rising US bond yields while on the other hand are positive global cues, a government committed to reforms and bring back the economy on track on backdrop of fading geopolitical tensions.

So, expect volatility to rule the roost and choppiness will prevail at Dalal Street for the rest of 2025 primarily as investors brace for a tug of war battle between the bulls and the bears.

Long story short: Stay cautious as long as tariff, rates, recession, and inflation are on the front pages…

The Five stocks to buy…

THE BEST FIVE STOCKS SIGNALLING MASSIVE BREAKOUT ON THE LONG TERM CHARTS…

| COMPANY | SECTOR | CMP | TARGET | POTENTIAL UPSIDE | INVESTMENT HORIZON |

| Interglobe Aviation | Airways, | 4,491 | 5,300 | 18% | 9-12 Months |

| Oberoi Reality | Real Estate | 1,846 | 2,350 | 27% | 12-15 Months |

| Bajaj Finance | NBFC | 8,000 | 10,500 | 31% | 12-15 Months |

| Redington | Trading & Distributors | 204 | 305 | 50% | 12-15 Months |

| Alivus Life Sciences | Pharma | 1,170 | 1,500 | 28% | 12-15 Months |