Are you among those who want to start investing but keep putting it off because you don’t know where to begin? Or perhaps you think the process is too time-consuming and complicated? Either way, we will share with you that the path to financial success is closer than you think. All you need is the right guidance and resources – and that’s where we come in!

Today, let’s explore how you can invest in the stock market with ease and precision, thanks to KSL.

Here are four ways we make investing accessible for everyone:

1. Trading Platforms

KSL’s trading platforms – KSL PRIVE, KSL EazyTrade, and KSL EazyWealth allow you to trade or invest in stocks, bonds, and commodities from the comfort of your home. Whether you’re an experienced trader or a curious newcomer, our platforms offer a gateway to unlimited potential and endless possibilities. With user-friendly interfaces and comprehensive tools, managing your investments has never been easier or more efficient.

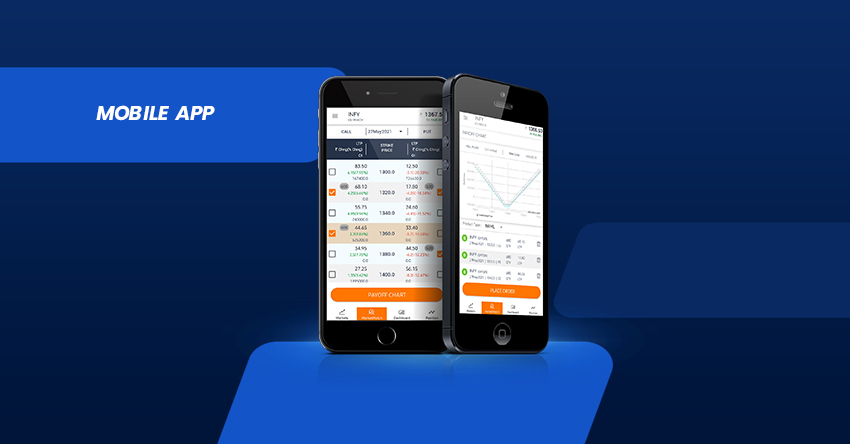

2. Mobile App

Opportunities can arise at any moment, which is why we’ve developed a sleek and intuitive mobile app. Our app empowers you to seize these opportunities on the go. You can trade stocks, analyze market trends, and manage your portfolio—all from the palm of your hand. The power of investing is now literally in your hands, keeping you connected to the market anytime, anywhere.

3. Call and Trade

For many, the stock market is a complex world filled with jargon. To make investing simpler, we offer a dedicated call and trade service. This service helps you execute trades and provides personalized insights tailored to your investment goals. Think of it as having a guiding hand whenever you need it. Now, expert assistance with your investments is just a phone call away.

4. Relationship Managers

Imagine having an expert by your side, offering strategic advice, timely recommendations, and continuous support as you navigate the highs and lows of the stock market. At KSL, we believe in the power of personalized guidance. Our relationship managers are here to ensure that you are not just a client, but a valued partner in financial success.

The road to financial freedom begins with a single step, and we are here to guide you every step of the way. Whether you prefer trading online, on your mobile device, or with the support of a dedicated advisor, KSL provides the tools, resources, and expertise to help you achieve your investment goals.